This gentleman wrote an Op-Ed published in the Seattle Fishwrap, AKA Seattle Times, and they edited out some of the most important information for Seattle voters (who basically govern Washington). Below is his entire post. The Seattle Fishwrap is evil for editing out the most important part of his essay!

Today I had an op-ed published in the @seattletimes explaining why Washingtonians should vote yes on initiative 2109 to repeal the anti-innovation, anti-small-business, capital gains tax that was created in 2021. I co-authored the op-ed with serial entrepreneur Marcus Charles, who is responsible for creating some of Seattle’s most iconic small businesses. I am deeply disappointed that my original text was edited, without my permission, by the Seattle Times to remove a crucial section explaining that proponents of the capital gains tax have already created new legislation (SB5335) to drastically lower the threshold at which the capital gains tax applies (down from $262,000 to $15,000) while also increasing the rate from 7% to 8.5%.

By censoring my op-ed, the Times is responsible for hiding crucial information from Washington’s citizens that erodes their ability to make an informed decision. The politicians who created the capital gains tax had always wanted an income tax in Washington and said so in private. Their strategy was to impose a capital gains tax, and market it to the public as tax that only affects the rich, while working behind the scenes to expand the tax to everyone and increase the rate. Washingtonians have one chance to reverse this massive and devious overreached by Olympia by voting yes on i-2109.

If we do not repeal the capital gains tax it will slowly but surely transform into the income tax that Olympia has repeatedly tried to impose on the people of Washington. Below you will find the un-edited version of my op-ed: —————-

Washingtonians all want a strong and vibrant economy. Our kids also deserve a world class public education system. In 2021 politicians in Olympia decided to create a capital gains tax with the ostensible goal of helping our public education system. Unfortunately, the capital gains income tax will do tremendous harm to our small businesses and tech sector without fixing the significant structural problems that plague our K-12 system. At the same time, politicians in Olympia are already trying to expand the tax to everyone’s income, including yours. Let’s begin with a simple question: what are capital gains?

They are profits from selling assets like small businesses, stocks, bonds, cryptocurrencies, and even homes. The IRS defines any capital gains tax as an income tax. So even though the State Supreme Court ruled it an excise tax, it’s just a smokescreen for a backdoor income tax on Washington voters. Those same voters have overwhelmingly rejected income taxes 11 times. Yes on 2109 protects Washington’s culture of no income taxes. Politicians in Olympia cynically promoted the capital gains tax as being necessary to help our children, while in private they explained that it was actually a strategy to circumvent Washington’s constitutional protections against an income tax. Voters have rejected income taxes eleven times in the last 90 years, so clearly some legislators knew they had to sneak their agenda through. The new tax was promoted as only applying to a small group of wealthy people but, as expected, legislators could not resist the temptation of expanding the tax to everyday Washingtonians.

Currently, the capital gains tax applies to profits over $262,000 from the sale of assets. However, Senate bill 5335 was introduced this year to lower the tax threshold to $15,000 and increase the tax rate from 7% to 8.5%. Home sales and retirement accounts are exempt for now, but given Olympia’s track record, it’s only a matter of time before they look for new ways to increase their revenue. The argument for taxing the wealthy may seem appealing, but the reality is more complicated. Wealthy individuals are the most mobile residents of any state. They can pick up and move to more tax-friendly environments whenever they choose and many have already done so. When they leave, they take their businesses, tax contributions, and the jobs they create with them.

This isn’t just a hypothetical scenario—it’s happening across the country in states that over-tax their residents. Connecticut, Massachusetts and California should all serve as cautionary tales. High income taxes in all three have driven out residents en masse, and California’s experiment with high taxes has caused such an exodus that the state lost representation in Congress for the first time. And let’s not forget, Washington State doesn’t have a revenue problem—it has a spending problem. Over the past five years, Washington has had a $19 billion budget surplus and our state’s constitution guarantees funding for education ahead of all other projects. Yet rather than using that surplus wisely, or reducing taxes, politicians have found new ways to squander our money. The capital gains tax hurts small businesses and the tech industry which are the most vibrant parts of our economy and the biggest drivers of jobs growth. In particular, small businesses with fewer than 500 employees are less able to pay additional benefits to their employees due to this new tax. The tax penalizes success, drives out talent, and discourages new entrepreneurs from settling in our state. It is well known that Amazon was founded in Washington due to our (previously) friendly tax policies. What would our state have looked like if Amazon had not been founded here and the tens of thousands of well-paying jobs it created had gone elsewhere? By repealing the capital gains income tax, I-2109 aims to protect small businesses, entrepreneurs and all Washingtonians from a backdoor income tax. If we continue to tax success, we risk losing the very people who help our economy thrive. Vote yes on I-2109, and let’s return Washington to its long tradition of not punishing success and welcoming the world’s best and brightest to our beautiful state.

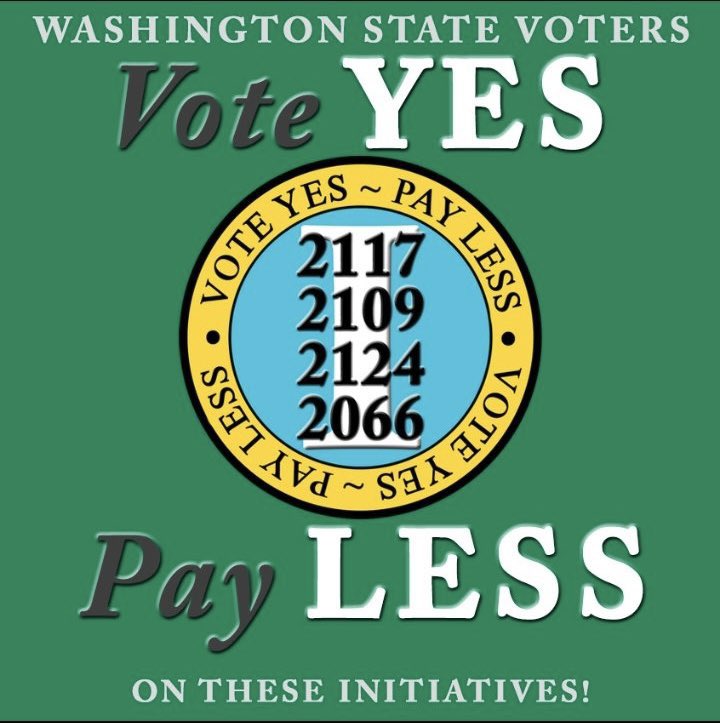

VOTE YES! PAY LESS!